If you’re in a situation where you need fast cash, but you don’t have a good credit score to get a personal loan from a bank, you may be considering applying for a no-credit-check personal loan. While these loans can be a lifesaver in a pinch, it’s important to understand all of the factors you should consider before applying.

One important thing to consider is the interest rate you’ll be charged on the loan. No credit check personal loans often have higher interest rates than traditional loans, so it’s important to make sure you can afford to repay the loan plus interest.

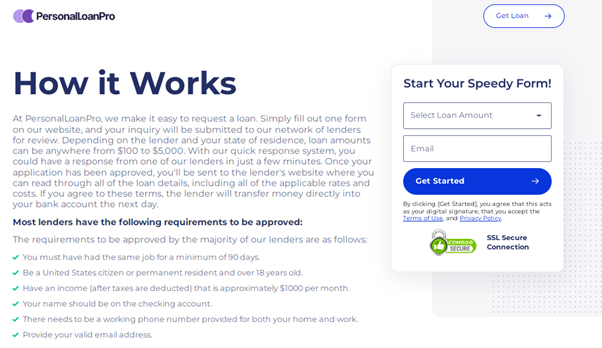

If you are looking for reasonable no-credit-check loans then online loan brokers like Personal Loan Pro can help you. In this link to the Personal Loan Pro homepage, you are allowed to receive different offers of online personal loans and find the best deal for you.

Another thing to consider is the fees associated with the loan. Some lenders may charge origination fees, late payment fees, or prepayment penalties. Make sure you know what fees you’ll be responsible for before you sign up for a loan.

You should also be aware of the terms of the loan. Some lenders require borrowers to pay the loan back in a short amount of time, while others allow borrowers to repay the loan over a longer period of time. Make sure the terms of the loan fit your budget and repayment schedule.

Finally, be sure to read the fine print before signing any paperwork. Sometimes no credit check personal loans come with hidden fees or other surprises. Make sure you know what you’re getting into before you apply.

If you take the time to consider all of these factors, you’ll be in a better position to decide if no credit check personal loan is the right option for you.

What Is Meant By No Credit Check Personal Loans?

When you need money quickly, a no-credit-check personal loan may be just what you need. These loans are designed for people who may have a poor credit history or no credit history at all.

A no-credit-check personal loan is a loan that is granted without any inquiry into your credit history. This means that even if you have bad credit or no credit at all, you may still be able to get a loan.

No credit check personal loans are a great option for people who need money quickly but may not have the best credit. They are also a great option for people who are looking to rebuild their credit.

If you are thinking about applying for a no-credit-check personal loan, be sure to do your research first. You can find no credit check personal loans from Personal Loan Pro easily. There are a number of different lenders connected with Personal Loan Pro, and not all of them are created equal. Make sure you compare interest rates and terms and conditions before you apply.

A no-credit-check personal loan can be a great way to get the money you need quickly. Just be sure to do your research first and compare lenders to find the best option for you.

Reasons To Get No Credit Check Personal Loans

There are many reasons to get a no-credit-check personal loan. Maybe you need to consolidate your debt, make a large purchase, or make some home improvements. Whatever your reasons, a no-credit-check personal loan can be a great solution.

One of the biggest benefits of a no-credit-check personal loan is that you can get approved even if you have bad credit. This can be a great option if you need to borrow money but have been turned down by other lenders.

Another benefit of a no-credit-check personal loan is that you can often get the money you need quickly. This can be a great option if you need money urgently for a big purchase or if you need to consolidate your debt.

Finally, no credit check personal loan can be a great way to rebuild your credit. If you use

If you’re looking for a great way to get a no-credit-check personal loan, be sure to check out Personal Loan Pro. The website can help you find the best lenders for your needs and get you approved for a loan quickly and easily.

Are No Credit Check Personal Loans Available Online?

Yes, these loans are available online. When you’re in a tough financial spot, it can be tempting to look for a loan with no credit check. After all, you don’t want your credit score to take a hit if you don’t have to. And you may think that a loan with no credit check is your only option.

But before you turn to no credit check personal loan, be sure to explore all of your options. There may be other solutions that are a better fit for your needs and won’t damage your credit score.

For example, if you need a small loan, you may want to consider a personal loan from a bank or credit union. These loans typically have lower interest rates than no-credit-check loans, and they can be a good option if you have a good credit score.

If you have a bad credit score, you may want to consider a secured loan. With a secured loan, you borrow money by putting up collateral, like your car or home. This can help you get a lower interest rate and may be a better option than a no-credit-check loan.

If you’re not sure whether you should get a no-credit-check loan, it’s a good idea to speak with a credit counselor. They can help you figure out what’s the best solution for your needs and may be able to help you improve your credit score.